The global 2023 Market Gain marketplace of finance is a dynamic terrain influenced by an intricate combination of economic data, investor emotion, and geopolitical concerns. As we approach 2023, the stock markets have exhibited signals of confidence, with advances across multiple indices.

However, doubts remain: Is this optimistic run economically viable, or are we just experiencing a bearish market bounce? A recent study provides insight into investor sentiment and predictions for the coming year.

2023 Market Gain: Market Belives

Over sixty percent of respondents feel the stock market’s increase this year is only a bear market bounce, and that more problems are on the way. 39% of investors feel we have already entered a fresh bull market.

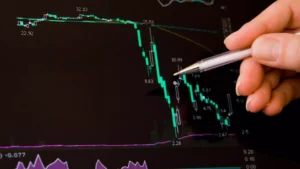

The S& P 500 has dropped more than 5% in a single month, reducing its 2023 earnings to 11%. Stocks fell as the Federal Reserve Board signaled higher rates of interest for a longer period of time, driving bond yields higher. 2023 Market Gain also had to battle with a crude oil spike and the dollar’s 10-week winning run.

Market Performance in 2023

To comprehend the current status of the financial sector, we must first evaluate the performance of major indices in early 2023. 2023 Market gain has increased noticeably across the board. Stocks have gained traction, and certain ones are reaching all-time highs. Bitcoin, assets, and real estate all have shown varied degrees of strength.

The reduction of pandemic-related limitations and the expectation of a return to before the pandemic economic activity have been important sources of market optimism. Investors are optimistic about long-term economic growth when industries rebuild and global supply networks stabilize.

The Phenomenon of Bear Market Bounce

As 2023 Market gain in the market are unquestionably welcome, they have aroused fears of a downturn in the market comeback. But, exactly, what is an adverse market bounce? In simple words, it refers to a brief and typically abrupt improvement in market performance inside a longer-term bear market.

Bear markets are distinguished by extended periods of falling asset values and negative sentiment. During these periods, investors may see small spikes or rebound before the underlying downturn resumes. These rises can sometimes instill a false feeling of hope in investors, leading them to assume that the financial crisis is over.

Understanding Investor Attitudes

CNBC conducted a detailed survey to determine how investors perceive market gains in 2023. The findings provide important insights into the prevalent sentiment:

Optimism:

A sizable proportion of those polled indicated enthusiasm about the current advances. They regard these favorable trends as evidence of the recovery of the economy and anticipate more development throughout the year.

Caution:

A different category of investors remains skeptical of the profits. They are aware of the bearish market bounce occurrence and predict market volatility will continue.

Expectations of a Recession:

Perhaps the most interesting conclusion is that a portion of those polled expect a recession in the near future. This viewpoint is motivated by concerns about issues such as inflation, supply chain disruptions, and global economic uncertainty.

The Way Forward

Investors and analysts will closely track market developments as we negotiate the difficult landscape of 2023. The dispute over whether the current gains are a bear market rebound or a long-term bull market will almost certainly continue.

Diversification, which managing risks and a long-term view is critical for shareholders in any market condition. While confidence may be in the air today, financial markets are notorious for their tendency to surprise. As a result, for investors in the next months, smart preparation and a thorough awareness of market movements will be vital assets.

Factors at Work

Several variables contribute to the ongoing dispute about whether the 2023 market gain are the result of a long-term bull industry or an unexpected bear market rebound:

Concerns about rising inflation rates: Inflation rates that are rising have been a source of concern. While central banks have taken steps to curb inflation, investors are nevertheless concerned about its impact on buying power as well as interest rates.

Conclusion

The 2023 Market Gain has sparked speculation about the possibility of a bear market comeback, tempering the current sense of optimism. The CNBC survey found a wide spectrum of investor attitudes, from those forecasting steady expansion to those ready for a recession.

Adaptability and a well-informed strategy will be critical in this volatile financial market. The exact nature of 2023 market gain performance—whether it forecasts a sustained bull market or hides the seeds of a negative resurgence—remains an unsettled subject that will only be answered with time and careful observation.