Government’s Proactive Approach: The Indian government recently revealed a ground-breaking plan to offer low-interest loans to individuals, marking a huge step towards financial inclusion and empowerment.

With its 5% interest rate and financial help, the 3 Lakh Loan Scheme has sparked optimism for a better economic future across the country.

This program is for artists who work in eighteen different professions. This comprises carpenters, blacksmiths, hammer and tool kit manufacturers, sculptors (including stone carvers), stone breakers, cobblers and shoe artists, masons, and locksmiths.

In addition to the typical doll and toy makers, barbers, garland makers, washermen, tailors, and artists and craftsmen involved in fishing net making, this also includes baskets, mats, brooms, and coir weavers.

Government’s Proactive Approach

A significant step towards the Pradhan Mantri Vishwakarma Yojana’s implementation has been made: on Monday, the Ministry of Skills Development announced the start of its first program.

November 6, 10, 2023 is the scheduled date for this program to be held at the National Institute of Entrepreneurship and Small Business Development (NIESBUD).

41 master trainers from ten states—Delhi, Gujarat, Haryana, Madhya Pradesh, Punjab, Rajasthan, Uttar Pradesh, Uttarakhand, West Bengal, and Chhattisgarh—will receive instruction during this five-day course.

There is no need for collateral to receive a loan up to Rs 3 lakh. There will be two payments of this sum. Under this, a loan of Rs 1 lakh and Rs 2 lakh will be disbursed in two installments at an interest rate of 5% for terms of 18 months and 30 months, respectively.

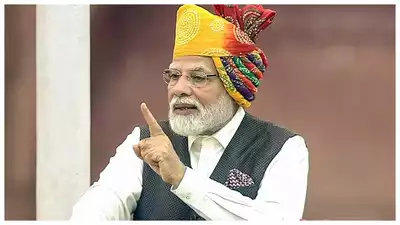

On September 17, 2023, Prime Minister Narendra Modi unveiled the PM Vishwakarma Yojana from the Red Fort’s ramparts, where he made the announcement during his 77th Independence Day speech.

The program seeks to aid small craftsmen and artisans around the nation with marketing, technical training, financial support, and skill upgrading.

Benefits to the Public for 3 Lakh Loan Scheme

- One of the scheme’s most alluring features is its incredibly low-interest rate of 5%. Long-term loan repayment is difficult for many borrowers due to the higher interest rates associated with them.

- A major financial relief for borrowers comes from the government’s decision to set interest rates at 5%.

- Loans Without Collateral, The 3 Lakh Loan Plan provides loans without collateral, which is a change from standard lending procedures.

- This indicates that pledging assets or property is not a requirement for loan approval. The beneficiaries’ pool is expanded by such a clause, particularly for individuals with modest holdings.

- The program provides borrowers with customized repayment plans that are flexible and based on their income and financial situation.

- By preventing repayment from becoming a hardship, this strategy frees up borrowers to concentrate on using the loan for worthwhile endeavors rather than stressing over strict payback plans.

- There is no shortage of demands when it comes to the 3 Lakh Loan Scheme. The program accepts applications from a broad spectrum of candidates, encouraging diversity.

- These applicants vary from small company owners hoping to grow their enterprises to students pursuing higher education and people in need of financial assistance for urgent medical needs.

This article covers the government’s proactive strategy for maintaining financial stability and growth for its citizens, as well as the complexities of this system.

Prospects for the Future

India’s socio-economic environment is expected to undergo a radical change with the introduction of the 3 Lakh Loan Scheme.

Increasing Entrepreneurship: The foundation of each economy is its small and medium-sized businesses or SMEs. The government enables company owners to launch or grow their enterprises by offering easily available loans with low-interest rates. This in turn promotes economic expansion, generates job opportunities, and advances the economy as a whole of the country.

Facilitating Higher Education: Education is a potent instrument for improving society. The 3 Lakh Loan Scheme guarantees access to higher education for meritorious students, regardless of their financial situation.

This democratization of education creates a workforce that is knowledgeable and skilled, which paves the way for a thriving and creative society.

Meeting Healthcare Needs: Medical emergencies frequently occur without warning, and the cost of receiving treatment can be prohibitive.

The scheme’s provision for medical loans ensures that individuals can access quality healthcare without compromising their financial stability. A healthier population and less financial strain on families follow from this.

Reducing Income Disparities: By creating chances for income generation, financing that is reasonably priced can aid in closing the income gap.

Previously shut out of official financial systems, people from marginalized groups now have an opportunity to better their financial situation.

Conclusion

Government’s Proactive Approach: The Indian government’s introduction of the 3 Lakh Loan Scheme under the Pradhan Mantri Vishwakarma Yojana is a proactive step towards financial inclusion. This loan provides assistance to artists and craftspeople in a variety of fields due to its low 5% interest rate, collateral-free nature, and customized repayment plans.

The government’s partnership with master trainers and emphasis on skill enhancement highlights its dedication to enabling small-business owners. This program, which addresses economic inequality, healthcare, and education, is a revolutionary idea that will promote entrepreneurship and build a more just society.

This program, which encourages inclusivity and economic growth, serves as a beacon of progress as India’s economic landscape changes.

Related Article: Shri Naib Singh Saini, Inspiring Act of Humility: Making Tea at Ramrai Bus Stand