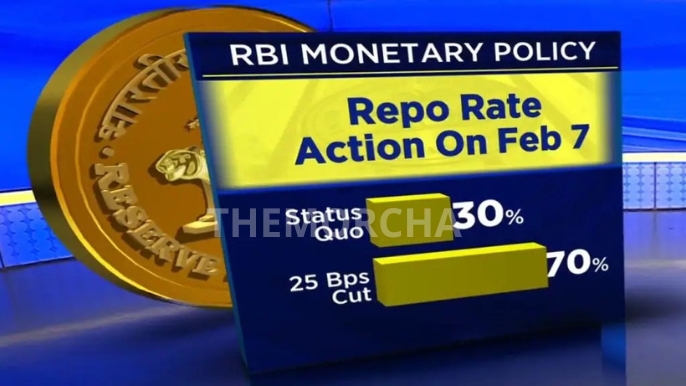

A key shift in the monetary policy direction was adopted by the RBI (Reserve Bank of India) in cutting the central bank’s policy interest rate or repo rate to 6.25%, decreasing it by 25 basis points. It happened at the MPC meeting held on February 7, 2025. For nearly five years, it was the first reduction in rates. The move aims to stimulate economic growth amid signs of easing inflation and a slowdown in economic activity. With global economic uncertainties and domestic challenges, this decision is expected to have far-reaching consequences for businesses, consumers, and investors alike.

Table of Contents

Understanding the Repo Rate and Its Impact

The repo rate is the rate at which the RBI lends money to commercial banks. A reduction in this rate means that borrowing would become cheaper for banks, who can then transfer the benefits down the line in the form of lower interest rates on loans offered to consumers and businesses. It is a way of encouraging expenditure and investment by boosting economic activity.

Home and car loans are cheaper, hence raising demand in real estate and automobile industries.

The business enterprise can borrow at a cheaper rate. Hence, investments in infrastructures and expansions would increase.

Consumer’s disposable income increases with a decrease in EMIs, hence, it will lead to higher expenditure and aggregate economic activities.

Economic Situation Which Results in Rate Cutting

1. Decreasing Growth of GDP

India’s economic growth has been facing headwinds, with projections indicating a slowdown. The annual growth rate is estimated to be 6.4% for the current fiscal year, marking the slowest pace in four years. Factors contributing to this deceleration include:

- Declining corporate investments: Many industries have been hesitant to make large-scale investments due to economic uncertainty and sluggish demand.

- Weaker manufacturing output: Industrial production has turned sluggish, with a negative impact on employment and exports.

- International slowdown: Trade tensions and escalating geopolitical risks worldwide have impacted Indian exports and foreign investments.

2. Inflation Trends and RBI’s Position

Inflation is an area that has been the RBI’s cause of concern since it has had a target inflation rate of 4% all these years. However, the inflation rates in the last few months have started to decline quite sharply:

The rate of inflation moderated to a four-month low at 5.22% in December 2024.

Forecasts predict the downward trend would continue due to lower food prices and falling fuel costs.

Since inflation seems to stabilize, RBI has found an opportunity to push economic growth with the help of reducing borrowing costs.

Shift in RBI Leadership and Policy Course

The rate cut decision comes on the heels of a significant leadership change within the RBI. In January 2025, the government appointed Sanjay Malhotra as the new Governor, succeeding Shaktikanta Das. Governor Das was known for his cautious approach, often resisting rate cuts due to inflation concerns. In contrast, Governor Malhotra is perceived as more dovish, prioritizing economic growth.

The transition of this leadership has seen much discussion in terms of RBI policy direction, balancing the goal of controlling inflation and promoting growth. The new RBI administration is giving hints towards a more accommodative stance suggesting that further cuts may be there in the near future if it so demands due to economic conditions.

Market Response and Investor Psychology

The RBI decision has drawn much interest from investors and market participants. Interest rates, in general, lower them. Generally, decreasing interest rates boost the economy through businesses and consumers. Still, analysts respond with a word of caution that the rate cut may not mean boosting the economy enough without fiscal policies.

The stock market reacted well to this kind of news. Indices witnessed a surge as investor confidence improved.

- Stock Market Boost: Banking, real estate, and automobiles saw the most growth.

- Rupee Fluctuation: A low interest rate may place some stress on the rupee against the dollar, hence on imports.

- Foreign Investments: Low interest rates will make India slightly less attractive for foreign investors seeking higher yields.

Global Comparisons: How Other Central Banks Are Responding

Along with monetary policy actions taken in India, the global trend is also centered around the adjustment of interest rates by central banks in response to changing economic conditions.

- The U.S. Federal Reserve has been cutting rates, but at a measured pace, to counterbalance persistent inflationary pressures.

- The European Central Bank (ECB) has been balancing growth concerns with control of inflation.

- China’s Central Bank has pursued aggressive monetary easing to revive its slowing economy.

These international events help place the RBI’s policies in perspective. The rate cut is consistent with the overall trend of the global easing of monetary policy to ensure economic growth continues.

Economic Growth and Inflation Trends Going Forward

The RBI’s rate cut is likely to have the following implications going forward:

1. Enhancing Investment and Corporate Growth

Lower borrowing costs will encourage business to invest in expansion and capital projects, thereby generating employment and raising productivity.

Infrastructure development could regain its pace with the decrease in financing costs.

2. Consumer Spending

Loans become cheaper with a lower interest rate. This may stimulate consumer expenditure on large ticket items such as homes and automobiles, which in turn will stimulate related industries.

Higher disposable income will help restore demand in the retail and service sectors.

3. Monitoring Inflation and Policy Rate Adjustment in Future

Overall, the trend shows easing of inflation. However, the RBI needs to remain vigilant to ensure that raising demand does not revive inflationary forces.

Future rate cuts will depend on how inflation evolves in the coming quarters.

4. External Shocks and International Economic Developments

External factors, such as global commodity price and geopolitical development, will continue to affect India’s economic journey.

The economic scenario of the country will depend heavily on the agreements in the area of trade, the changes in the oil prices, and foreign policy decisions.

Challenges and Risks With the Rate Cut

There are risks with this rate cut that will cause certain challenges:

- Risk of Over-Consumption of Loans: With the lowered interest rates, the propensity for excessive borrowing can be very risky for financial instability in the long run.

- Pressure on the Banking Sector: The banking sector will face trouble in sustaining their profit margins when lending rates start to decline.

- Uncertainty regarding Fiscal Policies: Unless the fiscal measures are not effectively implemented by the government, the monetary ease will not come to its potential.

A Strategic Step Towards Economic Revival

It marks a very significant moment in India’s economic policy landscape with RBI cutting the repo rate. At a time when the nation faces the challenges of slowing growth and evolving inflation dynamics, this measure underlines the commitment of the central bank towards creating an enabling environment for economic activity.

Effectiveness will be determined by the following:

- Whether commercial banks convert lower rates into accessible credit to consumers and businesses.

- How the government complements monetary easing with strategic fiscal policies.

- How external economic factors influence domestic growth in the coming months.

- The coming months will be pivotal for the adjustment of the Indian economy to the new change as the RBI works on its subsequent moves.

There is a prospect of further interest rate cuts in the pipeline; the inflation levels are expected to respond; further measures to pick up the tempo of economic growth; and above all, clear directions for its financial and economic future.